Sukanya Samriddhi Account (SSA) along with ‘Beti Bachao-Beti Padhao’ (BBB) will be officially launched on 22nd January, 2015. These schemes will be introduced by our honorable Prime Minister Narendra Modi.

Sukanya Samriddhi Account/Yojana is a Small Savings Special deposit Scheme for girl child. This scheme is specially designed for girl’s higher education or marriage needs.

Finance Minister Arun Jaitley had announced this scheme in his budget speech in July. The gazette on this scheme was released on 2nd December, 2014. On 21st January, 2015 the finance ministry released a notification with respect to the applicable interest rate on Sukanya Samriddhi Account.

Let us understand the features and benefits of Sukanya Samriddhi Account Special Savings deposit scheme.

Features of Sukanya Samriddhi Account (SSA):

- Who can open the account? – Sukanya Samriddhi a/c (or Khata) can be opened on a girl child’s name by her natural (biological) parents or legal guardian.

- What is the Age limit? – SSA can be opened in the name of a girl child from the birth of the girl child till she attains the age of ten years. (Girl child who is born on or after 02-12-2003 can open SSA/SSY account).

- How many accounts can be opened? – A depositor may open and operate only one account in the name of same girl child under this scheme. The depositor (or) guardian can open only two SSA accounts. There is one exception to this rule. The natural or legal guardian can open two or three accounts if twin girls are born as second birth or triplets are born in the first birth itself.

- How to open a SSA account (Sukanya Savings Account opening procedure)? Accounts in name of the girl child can be opened in post offices or in any branch of a commercial bank that is authorized by the Central Government to open an account under this scheme rules. As of now, the list is not drawn and many government owned banks are still in the process of completing formalities to open the Sukanya Samriddhi Yojana (SSY) Account, you may visit any of the government banks for the purpose of opening the account. (Some of these banks include – State Bank of India (SBI), SBH, Bank of Baroda, Punjab National Bank, Bank of India, Canara Bank, Andhra Bank, UCO Bank, Allahabad Bank, Corporation Bank etc.,)

- What is the minimum deposit to open the account? – The account may be opened with an initial deposit of one thousand rupees. The minimum contribution in any financial year is Rs 1000. Thereafter the contributions can in multiples of one hundred rupees.

- What is the maximum deposit amount? – a minimum of one thousand rupees shall be deposited in a financial year but the total money deposited in an account on a single occasion or on multiple occasions shall not exceed Rs 1.5 Lakh in a financial year.

- Deposits/contributions in an account may be made for fourteen years from the date of opening of the account.

- Is there any penalty? – If minimum (Rs 1000 pa) amount is not deposited, the account will be treated as an irregular account. This can be regularized/renewed on payment of Rs 50 per year as penalty. Along with this, the minimum specified subscription for the year (s) of default should be paid.

- What is the mode of deposit? – The deposits in Sukanya Samruddhi scheme can be made in the form of Cash or Demand Draft or Cheque. Where deposit is made by cheque or demand draft, the date of encashment of the cheque or demand draft shall be the date of credit to the account. The cheque or DD should be drawn in favour of the postmaster of the concerned post office or the Manager of the concerned bank.The depositor (parents or guardian) has to write the account holder’s name (child’s name) and the account number on the backside of the instrument.

- What is the Rate of Interest on Sukanya Samriddhi Account? – The applicable rate of interest on SSA for the financial year 2014-2015 is 9.1%. This is one of the highest rates of interest offered by Government on small savings scheme

- Is interest rate fixed or variable? – The rate of interest is not fixed and will be notified by the central government on a yearly basis.

- The account can be transferred anywhere in India if the girl shifts to a place other than the city or locality where the account stands.

- Is Premature withdrawal allowed? – 50 % (half of the fund) of the accumulated amount in SSA can be withdrawn for girl’s higher education and marriage after she attains 18 years of age. The account’s balance at the end of preceding financial year is used for the calculation.

- Can the girl child operate the account? On attaining age of ten years, the account holder that is the girl child may herself operate the account, however, deposit in the account may be made by the guardian or parents.

- Is premature closure allowed? In the event of death of the account holder, the account shall be closed immediately on production of death certificate. the balance at the credit of the account shall be paid along with interest till the month preceding the month of premature closure of the account , to the guardian of the account holder.

- The scheme would mature on completion of 21 years from the date of opening of the account, with an option of keeping the account till marriage. So, the maturity of the account is 21 years from the date of opening of account or if the girl gets married before completion of such 21 years (whichever is earlier).

- Can the girl child continue the account after her marriage? – The operation of the account shall not be permitted beyond the date of the girl’s marriage.

- What are the required documents to open Sukanya Samriddhi Account? – Birth certificate of the girl child has to be produced. The depositor (parents or guardian) has to submit his/her identity and address proofs.

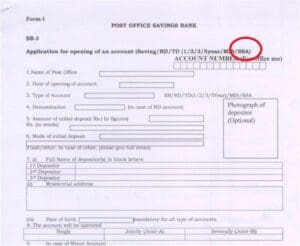

- Download Sukanya Samriddhi Account/Yojana (SSA/SSY) Application form. (This SSA applicaiton form that can be submitted at Post office. Download the file by clicking on the below image and go to ‘Form 1′ Post office Savings Bank page and you can take print out of the same)

- On opening an account, the depositor shall be given a pass book. It will have date of birth of the girl child, date of opening of account, account number, name and address of the account holder and the initial amount deposited. The depositor has to present the passbook to the post office or bank at the time of depositing/receiving the interest/on maturity.

Income Tax Benefits on Sukanya Samriddhi Account Scheme – Section 80c

The amount that is deposited under Sukanya Samriddhi Account will be eligible for income tax exemption under Section 80C of Income Tax Act, 1961.

At present, only the contribution of up to Rs 1.5 lakh toward Sukanya Samridhi Yojana is eligible for tax deduction under Section 80C. The maturity amount (withdrawal amount) is exempted from income tax. But discussions are on to also exempt the interest income. We can expect a formal announcement on this in the coming Union Budget 2015-16.

(Issue of making interest income exempt from taxation can be done by Department of Revenue (DoR) through legislative amendments. The matter is under examination of DoR)

PPF Account (Public Provident Fund) Vs Sukanya Samriddhi Account

PPF (Public Provident Fund) has E-E-E tax rule. As per this rule – contributions, accumulation (interest amount) and withdrawal are all exempted from income tax. There is a high chance thatSukanya Samruddhi Account may be brought under E-E-E catergory(As of now there is no official confirmation on this. Let us wait for more information).

For the fiscal year 2014-2015 the rate of interest on PPF account is 8.70% (upto March 2015). OnSukanya Samruddhi Account this is 9.10%. So, comparatively SSA has higher rate of interest. The interest on SSA will be calculated just like the way it is done on PPF a/c

Sukanya Samridhi Account – Interest Amount & Maturity Amount Calculation:

You may have few questions like : How is the interest amount calculated on Sukanya Samridhi Savings scheme? – What could be the total maturity amount on SSA Savings account? What is the total interest amount that I can earn on SSA?

Before proceeding with the calculations, below are the main points/assumptions with respect to interest and maturity amount calculations:

- The contributions are allowed upto 14 years from SSA account opening date.

- The SSA savings account can be operated till the completion of 21 years from the account opening date.

- The current applicable interest rate on SSA scheme is 9.1% (this rate of interest will vary in future, as per the Central Government’s future notifications.)

- The interest on SSA will be calculated just like the way it is done on PPF a/c. (PPF interest is calculated monthly on the lowest balance between the end of the 5th day and last day of month, however the total interest in the year is added back to PPF only at the year-end.)

- I have assumed the investments are done at the beginning of every month/year and calender year as April-March.

Sukanya Samriddhi Account/Yojna – Interest & Maturity amount calculation - Scenario 1-Monthly Deposit

Example 1 - Mr Aravind Swamy wants to open the Sukanya Samridhi Savings account in the name of his girl’s child (5 years old) in April 2015. He wants to contribute Rs 10,000 every month for 14 years. He also wants to keep this account active till 21 years from the account opening date (or till Child’s age of 25 years). He wants to know, what could be the total approximate interest amount and total maturity amount that he would accumulate under SSA?

As per above calculations, Mr Aravind Swamy can accumulate total interest amount to the tune of Rs 45.73 Lakh. The total maturity amount on his SSA savings account can be Rs 62.53 Lakh. He also has the option to withdraw 50% of Rs29.89 Lakh when his child turns 18 years. (If he withdraws, the total maturity amount will not be as shown above.)

The present value (PV) of Rs 62.53 Lakh (maturity amount ) is Rs 8.45 Lakh, assuming 10% as Education inflation (the rate at which education/marriage expenses may increase). Kindly think from this angle too.

Sukanya Samriddhi Account/Yojna – Interest & Maturity amount calculation – Scenario 2 – Yearly Deposit

Example 2 - Mr Madhavan wants to open the Sukanya Samridhi Savings account in the name of his girl’s child (5 years old) in April 2015. He wants to contribute Rs 1,20,000 every year for 14 years. He also wants to keep this account active till 21 years from the account opening date (or till Child’s age of 25 years). He wants to know, what could be the total approximate interest amount and total maturity amount that he would accumulate under SSA?

As per the above calculations, Mr Madhavan can accumulate total interest amount to the tune of Rs 46.32 Lakh. The total maturity amount on his SSA savings account can be Rs 63.12 Lakh. He also has the option to withdraw 50% of Rs 30.24 Lakh when his child turns 18 years. (If he withdraws, the total maturity amount will not be as shown above.)

Kindly note the difference in the maturity amounts between the ‘monthly contribution account’ and ‘yearly contribution account.’

My opinion on Sukanya Samriddhi Account Savings Scheme:

I can confidently say that the average rate of education inflation in India is somewhere around 10% to 15%. The rate at which marriage expenses are increasing is also very high.

Given this scenario, the 9.10% rate of interest may not beat the inflation. Unlike Bank fixed deposits, this rate of interest is not fixed.

The better way to create sufficient corpus for a Child’s education is to allocate major portion of savings to equity related instruments (if you have more than 10 years time frame). You can then consider investing small portion of your savings towards this scheme. This scheme can be considered as the DEBT component of your investment portfolio.

Another drawback of SSA is the number of accounts that can be operated. The number of accounts that are allowed to open under this scheme is limited to two accounts only. Parents of more than two girls can not open multiple Sukanya Samriddhi Accounts.

pmjjby scheme

ReplyDeleteThese are all about the wonder scheme named Sukanya Samridhi Yojana. If till date you have not let your dear daughter participated in this scheme then you should be quick enough before she crosses her 10th birthday.

ReplyDeletesukanya samridhi yojana

Such a wonderful information blog post on this topic Programming Assignment Help provides assignment service at affordable cost in a wide range of subject areas for all grade levels, we are already trusted by thousands of students who struggle to write their academic papers and also by those students who simply want PHP Assignment Help to save their time and make life easy.

ReplyDelete